LiQNET [LEN]

- Dapatkan link

- X

- Aplikasi Lainnya

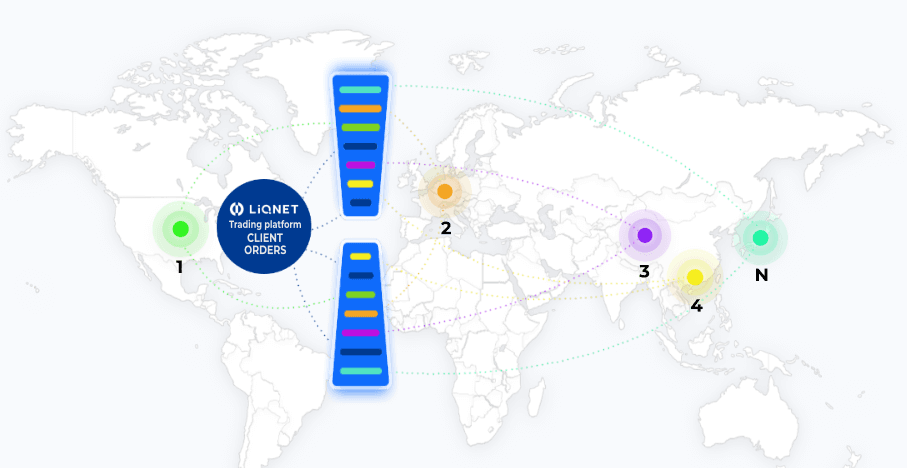

A unique new idea is the fact that the Liquidity Exchange Network mechanism gives an opportunity to collect data from stock exchanges all over the world and form a single exchange glass. A great advantage is the function with which you can see the entire book of orders in general, both on the LIQNET platform and on other services. It is also planned to launch futures and options trading for those who have the highest liquidity. The big difference is the fact that the team goes to the ICO with the finished product! It can already be tested https://liqnet.com/ Also more information is available in the BTT Access to trading is done through a professional web terminal that has

- A chart with tools for technical analysis

- All types and policies for their implementation

- Tools for marketing, scalping and more

LIQNET is a cryptoexchange, which allows for unite liquidity from different platforms and solve the problem of scattering of users, their trading requests, and orders, thus forming a unified order book with better market depth and better prices for private individuals and legal entities from various jurisdictions. What makes the LIQNET exchange unique is the LEN (Liquidity Exchange Network) tool, which allows you to collect and combine orders from the LIQNET's clients. The holders of the LEN tokens get privileged terms.

Hedging transactions.

A hedging operation is a position that a market participant takes to limit the risks associated with another position or transaction in which a market participant participates. A hedging operation usually involves derivatives, such as options or futures contracts, but this can be done using inversely proportional assets. Hedging transactions are usually used to limit the losses that a position encounters if the original embedding thesis is incorrect, but they can also used to block a certain amount of profit. The hedging transaction is a common tool for businesses, as well as portfolio managers seeking to reduce overall portfolio risk.

Automatic trading system.

All major platforms are aimed at increasing liquidity and trading volumes in their markets. The standard way to do this is to connect the platform API to automated trading systems (trading robots). Almost all crypto-exchanges provide such trading APIs. They view LEN as an automated trading system that makes numerous trading operations, thereby increasing liquidity and paying a commission for every transaction that makes a profit for them.

The automatic system of distribution and accounting of funds

Automated trading system (provides hedging of transactions with customers on "external" platforms) Automated system that allocates and takes into account funds (provides positive balances on "external" platforms, takes into account profitability as an additional tool automated trading system)

Pay for each transaction commission, bringing traders a profit

All major platforms are aimed at increasing liquidity and trading volumes in their markets. The standard way to do this is to connect the platform API to automated trading systems (trading robots). Almost all crypto-exchanges provide such trading APIs. They view LEN as an automated trading system that makes numerous trading operations, thereby increasing liquidity and paying a commission for every transaction that makes a profit for them. Take for example the exchange: LEN connects to exchanges using their open API, and produces through them a variety of trading operations, increasing the turnover of exchanges and paying commission for each operation, bringing profit to all participants in the process. It will be more effective. Because of LEN. LEN is a mechanism that, through the API, allows you to collect and combine data on requests for sale / purchase from many exchanges of crypto-currencies, which are located anywhere in the world, and form a single book of orders. LEN combines requests into a single stream, and because of this, users can make transactions at the best price with the minimum spread. Yes, it means one shopping site. Since LIQNET is a crypto-exchange that allows you to combine liquidity with VARIOUS PLATFORMS and solve the problem of dispersing users, their trade requests and orders, thus forming a single book of orders with a better market depth and more favorable prices for individuals and legal entities from different jurisdictions.

Road Map:

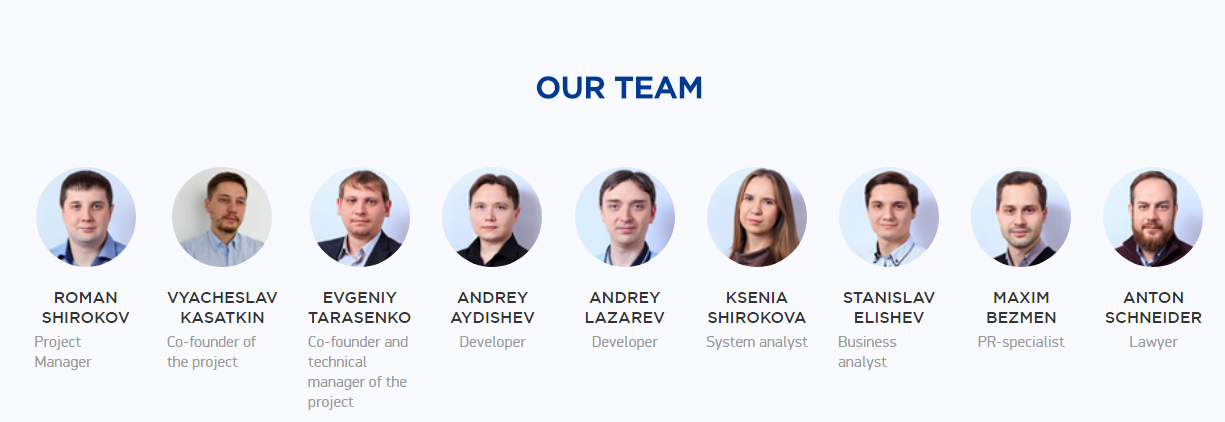

They are documented in Singapore. The team is chosen quite experienced, many have experience in their field from 5 years and above. This can mean only one thing that the team clearly knows what it does. Especially I liked the experience of developers, they worked with the giants of the Russian market and behind its chapels by various organizations. I want to note 9 years of experience in the sphere of finance Roman Shishkov who is the head of the investment campaign.

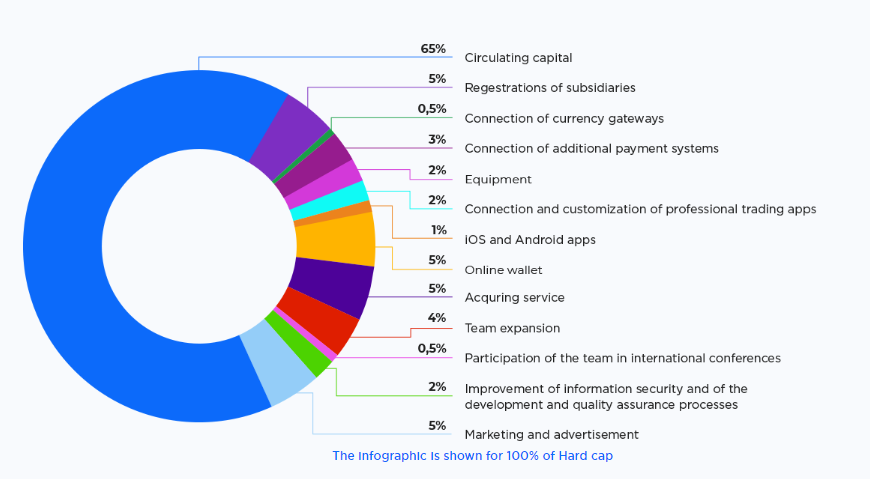

Now with regard to the immediate sale: 1Len = 1 $ I will not paint much, here everything is visible and more colorful and accessible. Photo distribution Now directly on the company’s bounty: Total allocated 1 200 000 LEN = 1 200 000 $ at the price of ICO What you need to do to participate

For more information :

Website: https://liqnet.io/

Whitepaper: https://liqnet.io/static/docs/Liqnet_WhitePaper_en.pdf

Annthread: https://bitcointalk.org/index.php?topic=3736633.0

Medium: https://medium.com/@liqnet.io

Facebook:https://web.facebook.com/LiqNet.io?_rdc=1&_rdr

Twetter: https://twitter.com/LIQNET_official

Author:sosisbakar12 :https://bitcointalk.org/index.php?action=profile;u=1865067

Website: https://liqnet.io/

Whitepaper: https://liqnet.io/static/docs/Liqnet_WhitePaper_en.pdf

Annthread: https://bitcointalk.org/index.php?topic=3736633.0

Medium: https://medium.com/@liqnet.io

Facebook:https://web.facebook.com/LiqNet.io?_rdc=1&_rdr

Twetter: https://twitter.com/LIQNET_official

Author:sosisbakar12 :https://bitcointalk.org/index.php?action=profile;u=1865067

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar